If you live in florida this guide will tell you how to set up up a living trust and also provide some relevant information to help you decide if a living trust is the right option for you.

Joint revocable living trust florida.

Upon your death or when the beneficiary reaches a certain age.

When one of the spouses dies the trust will then split into two trusts automatically.

The use of a joint revocable living trust as the primary estate planning instrument can be appropriate for certain married couples whose assets are uncomplicated and whose combined estates are not subject to the estate tax.

The joint revocable living trust jrt is a special type of revocable living trust that is created by two people grantors.

It is flexible because you can specify when you want the property or assets distributed i e.

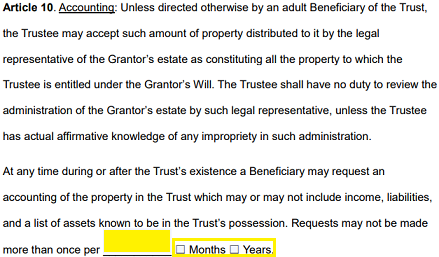

The florida revocable living trust is a legal form created by a person a grantor into which assets are placed with instructions on who will benefit from them the grantor appoints a trustee to manage the trust in the event they become mentally incapacitated.

While many attorneys swear by one trust over the other there are many factors such as the state in which the couple resides the total of their marital estate and the couple s relationship itself that contribute to the decision of which trust is.

The revocable or living trust is often promoted as a means of avoiding probate and saving taxes at death and is governed by chapter 736 florida statutes.

The revocable or living trust is often promoted as a means of avoiding probate and saving taxes at death.

The revocable trust has certain advantages over a traditional will but there are many factors to consider before you decide if a revocable trust is best suited to your overall estate.

So technically the one trust document creates a joint revocable living trust and then a separate trust for the husband and a separate trust for the wife.

The grantor may appoint themselves trustee which is an advantage over the irrevocable living trust.

The revocable trust has certain advantages over a traditional will but there are many factors to consider before you decide if a revocable trust is best suited to your overall estate plan.

Download this florida revocable living trust form in order to set aside certain assets and property of your choosing in a separate flexible entity for the benefit of your chosen beneficiaries.

A living trust is one way to plan your legacy and estate and to make things a bit easier for your family once you ve died.

An ab trust is a special type of trust that will protect the beneficiaries when one spouse dies and the trust is still revocable.

A joint living trust can however result in significant gift and estate tax problems in certain estates for which tax planning is required.

The option of creating the marital trust at the death of the first.

Deciding between joint and separate trusts for married couples has been a conundrum within the estate planning community for a long time.